Kroger

As one of the biggest corporate price gouging villains, Kroger increased grocery prices by 3.5 percent in 2021. Meanwhile, the grocery store made $1.7 billion in profits and paid its CEO $18 million that year.

Kroger’s CEO told investors “a little bit of inflation is always good in our business,” then announced price hikes. After “passing along higher cost to the customer,” the company saw its third quarter 2021 operating profit increase by $76 million over the prior year — contributing to a staggering $1 billion spent on buying back company stock in 2021.

As grocery prices increased 6.5%, the country’s largest grocery chains — Walmart, Kroger, and Costco — saw their fiscal year net incomes increase by a total of $238 million and increased stock buybacks and dividends by over $12 billion.

Workers across the country, including employees at 80 Kroger-owned stores, are organizing for higher wages and safe, secure working conditions while corporate executives and shareholders rake in profits.

Procter & Gamble

P&G, which accounted for 44% of market share in the U.S. diaper market as of 2017, increased pricing on its baby care products in February 2022 to protect its profit margins.

The company’s FY 2021 profits increased 10% to $14.3 billion and P&G returned $19.3 billion to shareholders — a $4.1 billion increase from FY 2020 — with its most recent quarter showing continued profit growth. On the company’s latest earnings call, executives told investors they are “thoughtfully executing tailored price increases” with more price hikes planned for essential items like feminine and oral care products this summer.

Procter & Gamble raked in $21 billion in the last quarter of 2021, in part because of raising prices for goods families need, like products to treat cold and cough symptoms and cleaning supplies. Chief Executive Jon Moller said recently these increased prices for consumers are helping the company “raise estimates for sales growth, cash productivity and cash return to shareowners.”

In early 2022, Procter & Gamble announced price increases in all 10 of their product categories. CEO Andre Schulten knows they can do that because consumers rely on their basic essentials, from baby care to feminine products to cleaning supplies. Hiking up prices on these essential products drove revenue 6% higher from the previous year and the company predicted more price increases to come.

Exxon

For the first three months of the year, Exxon reported that its profits doubled to $5.48 billion, compared to the same quarter last year.

This massive increase in profits comes as Exxon has raised gas prices on consumers and in spite of the company losing $3.4 billion from leaving its operations in Russia.

In Q1, Exxon returned $3.76 billion to shareholders, through stock buybacks and dividends.

The company’s CEO, Darren Woods, made nearly $24 million in 2021, and more than half of his compensation came from stocks. Exxon raised prices on consumers, while using increased profits to benefit shareholders and executives.

Tyson Foods

Over the last year, as meat prices have driven grocery inflation higher, meatpacker Tyson Foods has raked in massive profits. Tyson hiked its beef prices nearly 25% in its most recent quarter, compared to the same quarter last year, and it also raised pork and chicken prices more than 10%.

The company’s CEO, Donnie King, has even admitted that Tyson is “asking the customer and ultimately the consumer to pay for the inflation that we’re seeing throughout the supply chain.”

In February, Tyson reported bringing in $1.12 billion in net income in its prior fiscal quarter, and in 2021 the company paid its executives a total of $4.2 million more than in 2020, with its chairman receiving a $2.5 million pay increase.

What’s more, Tyson made record quarterly profits in its fiscal quarter that ended in October 2021 on the back of price hikes, despite selling less beef than the same quarter in 2020.

Tyson Foods Inc. in Q1 2022 also repurchased $348 million worth of shares, creating further value for its shareholders.

Kellogg’s

Earlier this year, Kellogg’s announced that it would raise prices to help blunt higher costs due to inflation, while over 1,400 cereal plant employees went on strike due to low wages and long hours. Though the strike has long ended, many consumers are still impacted by the high costs. All the while, the cereal company was still able to have a full year of market growth due to price increases.

In Q1 of this year, Kellogg’s reported a profit of $424 million or $1.23 a share, versus $371 million or $1.07 a share one year earlier, thanks to steady sales growth for its snack brands.

During the Q1 earnings call, Chairman of the Board and CEO Steven Cahillane said: “We grew our net sales faster than we had anticipated, and we delivered more operating profit than we had projected…This puts us in a good position, it allows us to affirm earnings guidance for the full year as an improved net sales outlet covers the impacts of accelerated cost inflation and supply disruptions…”

Marathon

As gasoline prices increased 49.6% in 2021, Marathon Petroleum was one of the three biggest US oil companies that collectively saw previously negative profits jump nearly $87.5 billion and boosted shareholder handouts by over $4.5 billion in FY 2021.

Marathon’s CEO Lee Tillman has admitted that the company’s “cash flow-driven return of capital framework uniquely prioritizes our shareholders as the first call on cash flow generation, not the drill bit.”

Most recently, gas prices hit an average of $4.12 a gallon in the past few months, reaching the highest they have been since 2014. Meanwhile, oil and gas CEOs made nearly $45 million more in 2021 than they did in 2020, with 28 major companies, including Marathon Petroleum, giving out a grand total of $394 million to their chief executives.

In Q1 of 2022, Marathon Petroleum Corp. posted first-quarter earnings of $845 million, or $1.49 a share, compared with a loss of $242 million, or 37 cents a share, in the year-earlier quarter.

Chevron

In 2021, Chevron reported their highest earnings since 2014 with $15 billion in earnings. Chevron’s CEO also said that 2021 was the “most successful year ever.”

As gasoline prices increased 49.6% in 2021, the three biggest US oil companies — including Chevron — saw previously negative profits jump nearly $87.5 billion and boosted shareholder handouts by over $4.5 billion in FY 2021.

Chevron CFO Pierre Breber said the company is “generating excess cash,” which it’s proffering to Wall Street through dividends instead of paying workers or keeping prices reasonable. As gas prices soared, Chevron’s 240% profit spike was part of “the best two quarters the company has ever seen.”

Chevron’s profit has more than quadrupled in the first quarter of 2022 reporting $6.3 billion in earnings during the period up from $1.37 billion during the same quarter in 2021.

Land O’Lakes

Land O’Lakes is one of the many companies accused of profiting off of the pandemic and blaming it on inflation. In a recent article, the company is shown to have a 48.1 percent net income margin increase from 2019-to 2021.

Land O’Lakes profits grew 11% in 2021 as dairy demand remained high even as the cooperative coped with higher costs and logistics challenges.

At the close of Q1, Land O’Lakes, Inc. reported net sales totaling $5 billion with net earnings of $179 million for the first quarter ending March 31, 2022, compared to net sales of $3.9 billion and net earnings of $136 million in first-quarter 2021.

Eli Lilly

With a recent investigation launched by the Michigan Attorney General, the Indiana based pharmaceutical company Eli Lilly has been under fire for increasing insulin prices. Eli Lilly is only one of three companies that control nearly 100 percent of the world’s insulin.

Reports have found that the three major manufacturers of insulin – including Eli Lilly – currently mark up the price of their insulin products by as much as 5,000 percent above the actual costs of manufacturing the drugs.

In the past decade alone, U.S. insulin list prices have tripled, according to an analysis of data from IBM Watson Health. In 1996, when Eli Lilly debuted its Humalog brand of insulin, the list price of a 10-milliliter vial was $21. The price of the same vial is now $275.

The outrageous price of insulin presents an obvious harm to patients. A study published in the January 2019 issue of the Journal of the American Medical Association Internal Medicine examined how often patients underuse their insulin because of cost.

General Mills

Back in March, cereal company General Mills mentioned that it saw a quarterly net increase of 11% to $660 million and spent $934 million on dividends this fiscal year after price hikes of up to 20% on hundreds of items in January.

Late last year, General Mills said they expected strong fourth-quarter numbers thanks to “ongoing elevated consumer demand for food at home.”

At the top of 2022, General Mills notified retail customers that they would be raising prices in mid-January across dozens of brands supposedly to contend with higher material and labor costs. However, the company proceeded to bring in over $3 billion in profits in 2021, up from the year before.

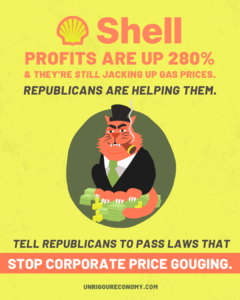

Shell

With gas prices at an all time high, Big Oil companies like Shell had a 49 percent increase in revenue. Along with other gas companies, Shell made $174 billion in revenue last year. Shell CEO Ben Van Beurden even described 2021 as a “momentous year” for the company and said progress made in the last year would let the firm “be bolder and move faster.”

In its earnings report for the first quarter of 2022, Shell reported a net income of $9.13 billion — nearly triple of the $3.2 billion reported in the same quarter last year — beating out its previous record from 2008.

Of the firm’s $8.5 billion share buyback program announced for the first half of the year, Shell said $4 billion had been completed to date. The remaining $4.5 billion share buybacks are scheduled to be completed before the announcement of second-quarter earnings.