To: Interested Parties

From: Leor Tal, Campaign Director for Unrig Our Economy

Date: January 15, 2026

Subject: Every Single Republican Still Owns Health Care Price Hikes

Talk is cheap. Health insurance is not. Republicans made extending tax breaks for billionaires – and historic and devastating cuts to Medicaid – their number priority one and got it over the finish line. But they failed to do the same for lowering Americans’ health care costs and now millions of working families are facing higher premiums and struggling to afford health insurance.

Health care tax credits have expired. Open Enrollment is ending in most states, and Americans are already paying sky-high premiums.

Now, every single Republican in Congress owns this health care crisis.

Despite 17 House and 4 Senate Republicans bowing to sustained pressure from their constituents and ultimately voting to extend the tax credits, their absolutely last minute support was too late to avoid raising health insurance costs for consumers.

Congressional Republicans even kept the government shut down last fall rather than working to extend the ACA tax credits before it was too late to stop Americans from seeing health insurance price spikes. Finally signing the discharge petition in late December when the tax credits were all but certain to lapse was too late.

Georgetown Center on Health Insurance Reforms on October 15:

Indeed, Congress has already waited too long. Even if the enhancements were to be extended tomorrow, millions of people now inevitably face higher premiums for the year, because insurance companies have finalized their rates assuming that smaller PTCs [health care tax credits] will push healthy people out…If an extension passes at year’s end, coverage losses will be 1.5 million due to the delays alone, according to published reports citing CBO estimates…timing matters, too. With 2026 rates already set and consumers starting to learn of premium increases, delays in extending the PTC enhancements beyond 2025 have already led to cost increases and coverage losses that cannot be reversed.

And these cost increases come on top of the largest Medicaid cut in history, which was supported by nearly every Congressional Republican.

Unrig Our Economy has spent more than $10 million on TV, online, and radio ads holding Republicans accountable for voting to jeopardize the health coverage of millions. And we intend to continue holding them accountable, including the few Republicans who eventually – after months of intense pressure, dire polling, and sustained protests – voted to extend the ACA tax credits.

Below is a non-exhaustive timeline of every time Republicans refused to extend health care tax credits, pushing us toward the health care crisis we’re in:

July 4 – Despite warnings from advocates, Congressional Republicans refuse to include expiring health care tax credits in the Republican Tax Law and, instead, prioritized expiring tax breaks for the ultra-wealthy.

“…the ‘One Big Beautiful Bill Act’ is missing something health care advocates hoped to see: an extension of the insurance premium tax credits under the enhanced Affordable Care Act that are set to expire at the end of the year. The credits’ absence is notable as the bill includes other proposed changes to the ACA marketplace, experts say.”

KFF Health News: Four Ways Trump’s ‘One Big Beautiful Bill’ Would Undermine Access to Obamacare

“Major changes could be in store for the more than 24 million people with health coverage under the Affordable Care Act, including how and when they can enroll, the paperwork required, and, crucially, the premiums they pay. A driver behind these changes is the…The House-passed One Big Beautiful Bill Act, which runs more than 1,000 pages, would create paperwork requirements that could delay access to tax credits for some enrollees, potentially raising the cost of their insurance…Enhanced tax credits created during the pandemic expire at the end of the year. The House bill doesn’t extend them. Those more generous payments are credited with helping double ACA enrollment since 2020.”

October 1 – Congressional Republicans refuse to extend tax credits by the October 1 deadline to prevent higher insurance premiums from being locked in by insurance companies and shutting down the government.

National Association of Insurance Commissioners:

“NAIC has voiced its strong support for continuation of the enhanced premium tax credits for Marketplace coverage. The enhanced credits expire at the end of this year, but health insurance premiums for 2026 must be finalized much sooner. Health insurers have already filed their initial rates for 2026, and state regulators are poised to give them final approval in the coming weeks. We must complete this action soon in order to make plans available for the annual Open Enrollment Period that begins on November 1.”

Georgetown Center on Health Insurance Reforms:

“On September 23, CMS announced that insurers would have until October 1 to make any changes to premium rates, and until October 2 to sign their contracts with the federal Marketplace. They have now reached a ‘pencils down’ moment…In other words, CBO believes that a premium increase of about 5 percent is already locked in. Any such late rate revisions would also impose costs on issuers, Marketplaces, and state regulators that would be passed along to consumers and taxpayers.”

“An assumed enactment after September 30, 2025, would affect CBO’s estimates in two ways. First, in CBO’s estimates, the likelihood that gross premiums for 2026 would be adjusted downward would fall to zero after the start of open enrollment. November 1, 2025, is the start of the enrollment period for the 2026 plan year in most marketplaces. Second, the estimates would reflect a smaller likelihood that enrollees will see net premiums that incorporate the expanded credit structure at the time they select their marketplace plan (the net premium is the amount of the premium after accounting for the tax credit). CBO estimates that an enactment date later than September 30 would result in lower costs to the federal government and smaller increases in 2026 enrollment than those presented here.”

November 1 – Congressional Republicans refuse to extend coverage by the start of Open Enrollment, as consumers drop coverage to avoid price hikes.

Georgetown Center on Health Insurance Reforms:

“On November 1, the open enrollment period opens nationwide (and October 15 in Idaho). At that point, both new applicants trying to enroll and current enrollees updating their applications and shopping will see the higher net premiums, deterring many from enrolling.”

December 15 – Congressional Republicans refuse to extend tax credits by day when when millions of Americans became auto-enrolled in health insurance plans they may no longer be able to afford.

Georgetown Center on Health Insurance Reforms:

“In December, all enrollees–including those auto-reenrolled–will receive their January 2026 bills showing their net premium for 2026. For auto-reenrollees in the federal Marketplace who don’t go in to shop, this will generally be the first time they see the higher premium, resulting in an additional round of disenrollment… In addition, December 15 is the last day to enroll for January 1 coverage in the federal Marketplace.”

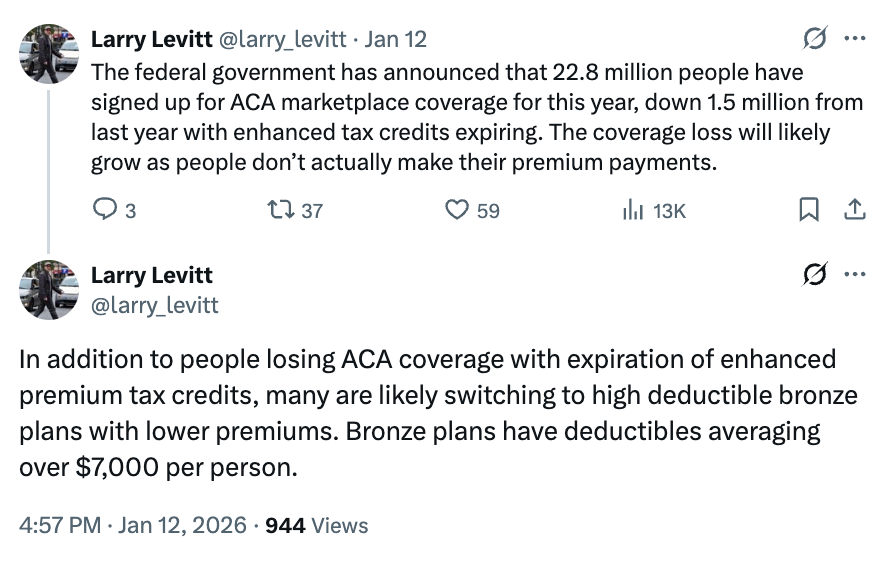

January 15 – Congressional Republicans refuse to extend tax credits by the end of Open Enrollment in most states, locking in high costs and causing many to lose coverage.

Georgetown Center on Health Insurance Reforms:

“The open enrollment period ends on January 15 in the federal Marketplace and most state Marketplaces. This will lock in consumers’ coverage decisions and plan choices. They will not be able to enroll in coverage without a special enrollment period. Some consumers will still enroll but will be more likely to disenroll later due to higher out-of-pocket costs.”

Every single Republican member of Congress owns the health care crisis, forcing millions of Americans to lose coverage and millions more to pay hundreds and thousands of dollars more for the care they need.

Washington Republicans can run but they can’t hide. They increased health care costs for millions of Americans. And Unrig Our Economy will continue helping their constituents demand that they stop raising costs and put working families first.

Watch Unrig Our Economy’s latest ad targeting Congressman Mike Lawler (NY-17) demonstrating that we’ll continue holding Republicans accountable for endangering Americans’ health coverage.